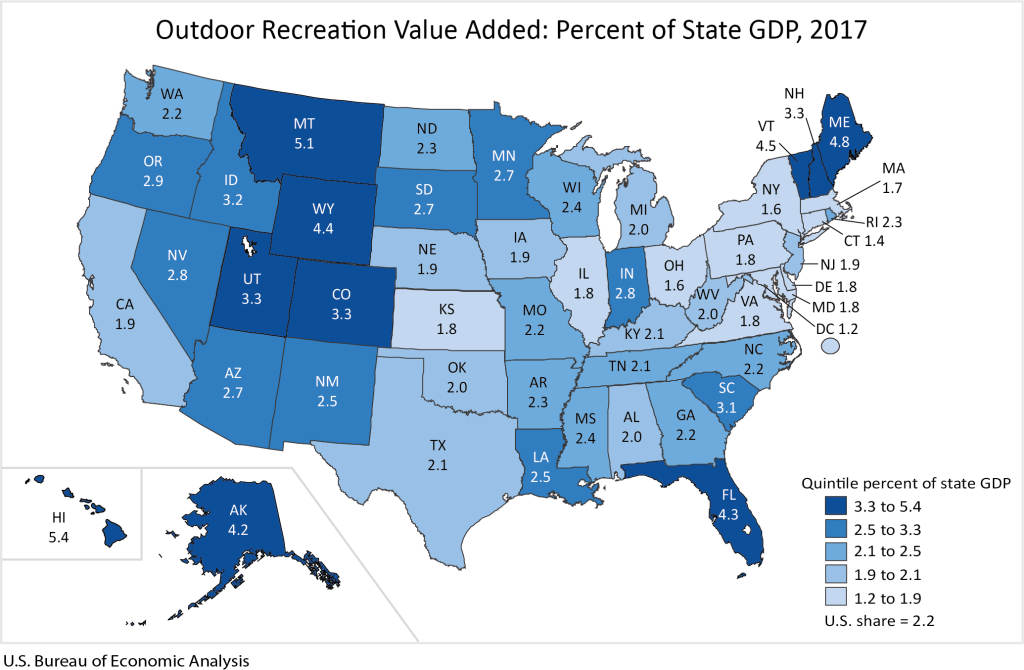

The outdoor recreation economy grew faster than the overall U.S. economy in 2017 and accounted for 2.2 percent of U.S. GDP, according to a report released Friday by the Department of Commerce’s Bureau of Economic Analysis (BEA). In a first-ever prototype report, bureau economists also determined the relative size of the outdoor recreation industry by state. In 2017, the recreation economy contributed 5.4 percent of state GDP in Hawaii and 1.2 percent in the District of Columbia.

Each state benefits in some way from the outdoor recreation industry. RVing is a major asset in Indiana. Boating is popular in Michigan and Florida. Hawaii is a tourist hub. And Colorado’s slopes attract seasonal skiers.

But the BEA’s state prototype gives an in-depth glimpse into just how much outdoor recreation contributes to each state’s economy, perhaps opening the door for state groups to better influence public policy related to outdoor recreation.

The BEA data includes a range of outdoor activities from camping, outdoor concerts and gardening to travel and tourism, manufacturing, and government spending, according to the BEA.

Overall, U.S. outdoor recreation accounted for $427 billion (or 2.2 percent) of the nation’s GDP and grew at a rate of 3.9 percent in 2017—injecting more money into the economy that year than either agriculture or mining. Comparatively, the U.S. economy grew by 2.4 percent in 2017. This state prototype is a follow-up to a report released in September 2018 that compared the economic impact of outdoor recreation to other industries.

Brad Garmon, director of the Michigan Office of Outdoor Recreation Industry, said the state analysis provides valuable insight into how states can support different sectors of their economy. For instance, Garmon said boating is a major part of the Michigan economy. He could use the data to support the need to address aquatic invasive species.

“To actually put numbers on it and say, ‘Look, this is a sector worth investing in,’ … I think that’s going to be a valuable piece of the puzzle,” he said.

Jessica Wahl, executive director at Outdoor Recreation Roundtable, said the data validates the need for public policy that supports the outdoor recreation industry.

“This data [shows] that [the outdoor industry] is really core to some states’ vibrant economies,” Wahl said. She used Indiana and Colorado as examples of economies bolstered by the outdoor industry.

For instance, the state prototype shows that outdoor recreation accounts for 2.8 percent of Indiana’s GDP, thanks in large part to the manufacturing of RVs and RV accessories, which was the second-largest conventional activity nationally and generated $2.9 billion for Indiana in 2017. Snow activities were the sixth-largest conventional activity at the national level, bringing in $5.6 billion current-dollar value added, according to the state prototype. Snow activities generated $1.5 billion in Colorado alone.

Map Courtesy: Bureau of Economic Analysis

BEA’s state prototype measures contributions to the U.S. GDP—or total value of finished goods and services in a country—and GDP outputs. Therefore, it only includes goods and services produced in the U.S., said Ann McDonel, BEA spokesperson.

The Outdoor Industry Association, a trade group for the outdoor industry, released its own numbers in 2017. Those figures diverge from BEA’s because the OIA focused on different economic factors. Unlike BEA, OIA’s data also include spending on imported goods. In the past, the data also differed because OIA measured travel expenses on close-to-home recreation whereas BEA did not, said Samantha Searles, OIA director of research. However, Thomas Dail, BEA spokesperson, said that has since changed and the most recent data also includes close-to-home trips. Those trips, Searles said, represented 67 percent of the $887 billion in consumer spending that OIA measured in 2016.

Searles said that both BEA’s and OIA’s measurements of the outdoor industry have become increasingly inclusive with regard to the types of activities they measure. For instance, “gateway activities,” like indoor climbing, are now included in some reports. BEA also includes money generated by festivals and parks in its data, she said.

The data also includes activities that support recreation, like travel and tourism, construction and government spending. These activities comprise 50 percent of the data. Wahl said this shows how the recreation economy can contribute to a state’s workforce.

“One of the trends we’re starting to see is the value of consumer interests and consumer spending … in a variety of outdoor recreation [activities],” Searles said. She added that both BEA and OIA have continuously expanded the definition so as not to limit the capabilities of the outdoor industry.

Wahl echoed this point, adding that the outdoor recreation industry is responsible for myriad jobs that overlap with other disciplines, including work in the manufacturing, communications and engineering sectors, to name a few. Searles noted the data provides “a very telling story about the impact we have not only in our industry but across industries. Outdoor recreation doesn’t live in a silo.”

The BEA’s state prototype is open to public comment through March 31, 2020, after which the agency will release a final report. To submit a comment, email outdoorrecreation@bea.gov. For more information about the contribution of the outdoor industry to your state’s economy, read the full report here.

Read more: